Checked & unbalanced

10th December, 2021 I’m often educated by my law trained business partner as to…

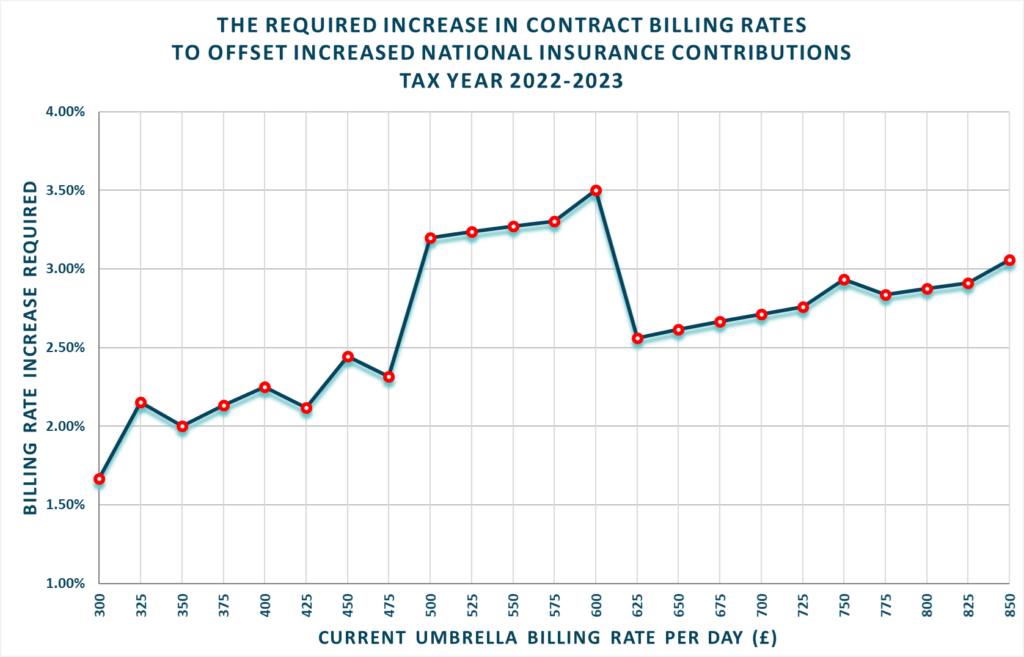

In our recent article we looked at how umbrella workers will be impacted by the 1.25% points increase in Class 1 Employers and Employees National Insurance contribution rates that will be used to fund the new Health and Social Care Levy.

Allowing for the increase in the Employees Primary Threshold to £12,570, announced during the Chancellor’s Spring Statement, an umbrella worker with a billing rate of £600 per day will see their take home pay reduce by £1,514 during the 2022-2023 tax year.

It’s worth pointing out the percentage increase required is more pronounced for those with a contract billing rate between £500 and £625 per day. This is because any increase in contract income, will also increase the amount of income tax payable and for anyone earning in excess of £100,000 they will gradually lose their personal tax-free allowance. Therefore, a greater increase is required to match the take home pay received in the previous tax year.

At its worst and without considering any cost-of-living increase, an umbrella worker with a current billing rate of £600 per day will require a £21 (3.5%) per day increase in their billing rate from April 6th to achieve a similar take home pay during 2022-2023 tax year.

For anyone looking to negotiate an increase in their billing rate, please do not hesitate to get in contact and we will be happy to share our detailed calculations.

Article

Article

10th December, 2021 I’m often educated by my law trained business partner as to…

Article

Article

2nd July, 2021 Crypto Tax- What can we learn from the US? Introduction The…

Article

Article

Making Tax Digital (MTD): What It Means for Small Businesses and the Self-Employed If…

Article

Article

As the end of the tax year approaches, many individuals and business owners begin…

Article

Article

UK Recruiters Expanding to the US Over the past few years, a noticeable shift…

We’d love to hear from you!

Whether you simply have a quick question, or were seeking a more formal conversation to discuss your tax needs, drop your details here and we will be in touch! Alternatively, you can contact us on +44 (0)20 3468 0000.