Checked & unbalanced

10th December, 2021 I’m often educated by my law trained business partner as to…

Since the off-payroll working reforms were introduced to the private sector in April last year, requiring all but the smallest of companies to assess their contractors employment status for tax, the industry has seen a significant increase in the use of umbrella companies.

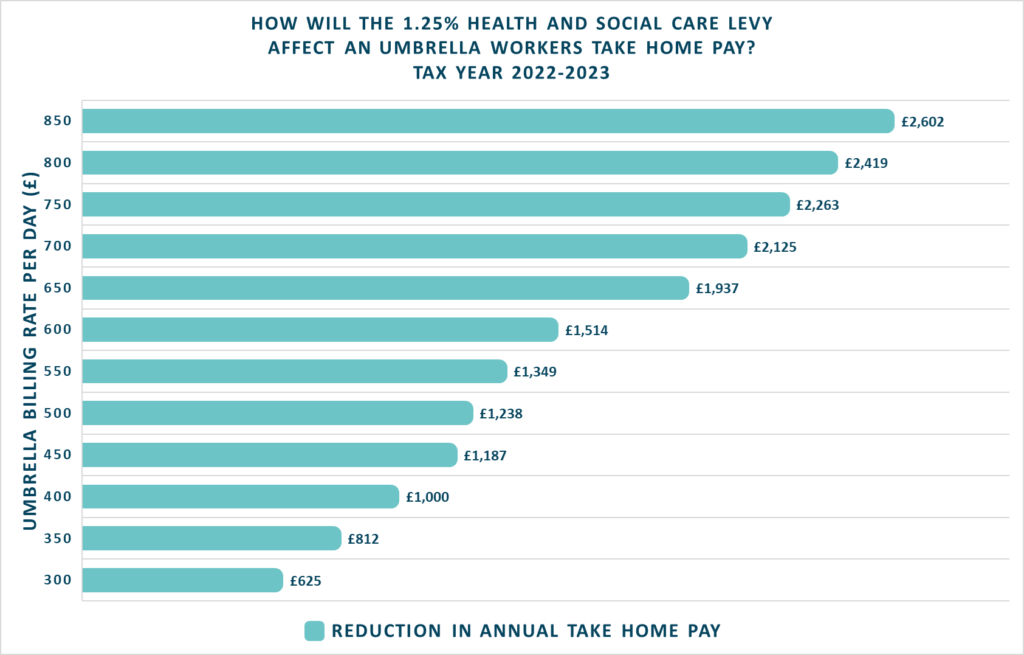

With the new tax year upon us, a typical umbrella worker with a billing rate of £40 per hour (£300 per day) will see a £625 reduction in their annual take home pay from April 6th.

Those with a higher billing rate of £80 per hour (£600 per day) stand to lose £1,514.

This is because most umbrella workers will be expected to absorb the additional 1.25% that will be added both Class 1 Employers and Employees National Insurance Contributions from April 2022.

The increase in contributions will be used to pay for the new Health and Social Care Levy, and unless end clients agree to compensate with increased billing rates, umbrella pay calculations will need to absorb additional deductions totalling 2.5%, whereas a traditional employee will pay just 1.25%.

Given so many of these workers operate in the very sector the new levy is designed to help, it seems somewhat unfair that they could be coming off the worst.

We would urge contractors to recognise this in future contract negotiations and it is evidently an important factor in the need for increased transparency in the supply chain. With a continued squeeze on the cost of living, the stark impact on contractors should be counterbalanced by the supply chain absorbing cost, to ensure the contracting market thrives in a time when it is needed most

In part two, we’ll discuss how much contract billing rates need to increase.

Article

Article

10th December, 2021 I’m often educated by my law trained business partner as to…

Article

Article

2nd July, 2021 Crypto Tax- What can we learn from the US? Introduction The…

Article

Article

Umbrella Company Compliance Umbrella companies are a popular solution for contractors seeking an efficient…

Article

Article

How Do I Liquidate My Limited Company? If you’re considering closing down your limited…

Article

Article

Child Benefit Tax Return Rules Are Changing – What Is the High-Income Child Benefit…

We’d love to hear from you!

Whether you simply have a quick question, or were seeking a more formal conversation to discuss your tax needs, drop your details here and we will be in touch! Alternatively, you can contact us on +44 (0)20 3468 0000.