Checked & unbalanced

10th December, 2021 I’m often educated by my law trained business partner as to…

Last year I wrote an article concerning HMRC’s use of S.684 notices, which at the time were focused on ex-employees of Edge and AML. You can read my original article here.

Since then, matters have progressed substantially, including us issuing over 120 Judicial Review applications to The Administrative Court in an effort to protect our clients. HMRC has also been adding a number of arrangements to the catalogue of schemes targeted. These include;

• Horizon

• Sanzar Solutions

• DarwinPay

• Trentburg

• Marra

• Greenbay

• Momentum

• Merchant

I will continue to update this list as new names are added. But for now, the basis of my article focuses on where we think HMRC are wrong and what recipients of these notices can do in response.

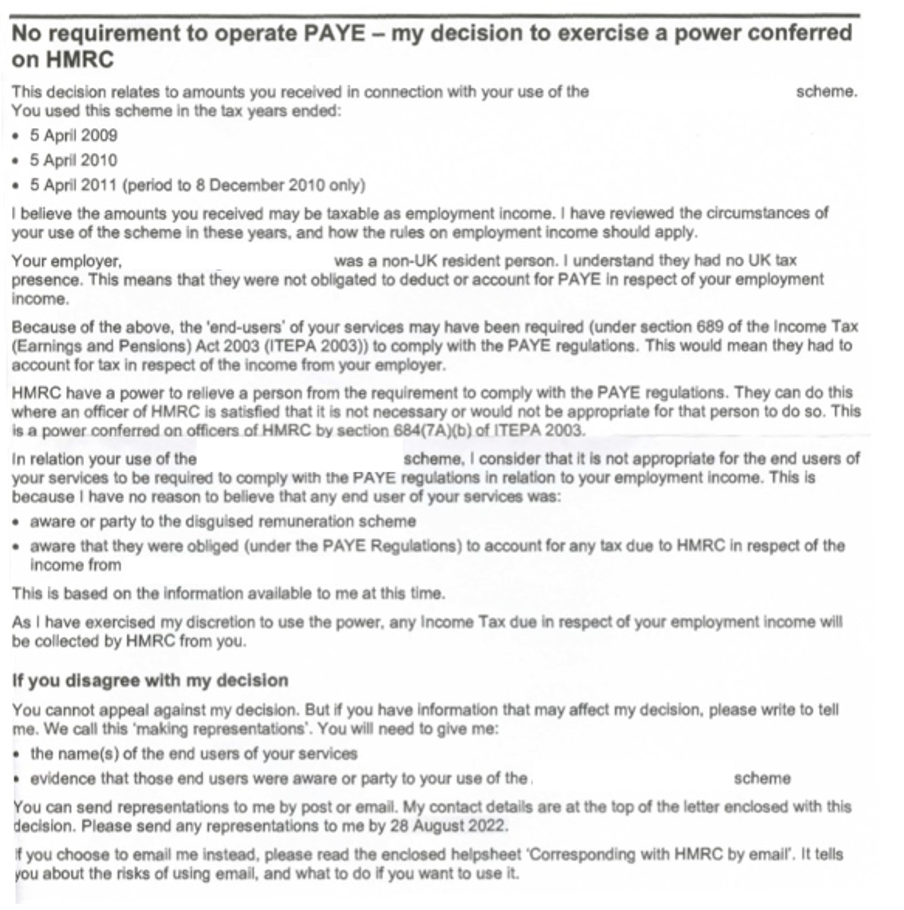

An extract of the notice can be found below. It will be noted that the key statements made by HMRC are;

• “Your employer (being the umbrella) had no UK-tax presence”

• “I have exercised my discretion” to disapply the PAYE rules due to this.

• Therefore, “any income Tax due to HMRC will be collected by HMRC from you”.

Ultimately, HMRC rely on the fact that there is no UK presence of the employer, due to it being based overseas, in order to exercise a discretion to remove from any actual or deemed employer an obligation to make PAYE deductions.

We consider HMRC’s view to be inaccurate and a misuse (possibly, abuse) of their discretion.

In Clark (Inspector of Taxes) v Oceanic Contractors Inc [1983] 2 AC 130, the House of Lords held that the territorial scope of the PAYE system was limited to persons with sufficient tax presence in the UK. This does not align with HMRC’s view which leads to the issue of a notice.

In Oceanic, having regard to the nature of the trade which was the provision of a workforce in the UK to UK-based end-users (common to umbrella arrangements) and the fact that they had an exclusive agent in the UK which handled all administrative matters the House of Lords held that Oceanic did have a tax presence in the UK sufficient to bring them within the scope of the PAYE Regulations. Oceanic was therefore obligated to deduct and pay over PAYE.

This means that where we can show that there was a UK entity acting as de facto promoter/employer or that the offshore ”employer” had an exclusive agent, based in the UK, it may be enough to bring them into the PAYE Regulations therefore defeating HMRC’s attempt to disapply it and collect the tax from you rather than the employer.

It should be remembered that many offshore schemes took great pains to have the audit trail, as seen from the end client’s perspective, end with a UK entity because many end clients would not deal with an offshore entity. This is going to be a very helpful factor here.

For the purposes of this article, I will take Edge as an example. All new employees of Edge were first enrolled by Norla Consulting Limited, a company based in Coventry.

In Norla’s introductory communication it states;

“We have a Master Supply Agreement with your employer, Edge Consulting. Before we are able to make payments to you, Norla requires the following documents to be sent to us”.

On an ongoing basis, contractors would engage with Norla where there were issues with payroll, queries on payment and general contract matters. Similarly, Norla communicated with all supply chain companies being the agencies and end-hirers on an ongoing basis.

It is therefore asserted that Norla was an exclusive agent for Edge and operated a PAYE scheme either on behalf of Edge or because they saw themselves as an agency, in exactly the same way as mentioned in the Oceanic case above. As a result, and as determined by the House of Lords in Oceanic “they have a tax presence in the UK sufficient to bring them within scope of the PAYE Regulations”.

Where this can be proven, HMRC is unable to exercise their discretion and should instead collect tax from the employer.

It is unfortunate that HMRC has overlooked this matter, instead taking fifteen years in some instances to reach an incorrect position. In order to hold HMRC to account on this, you need to respond within the window given in the notice (30 days) asserting your own position as to the UK company in your supply chain. For the avoidance of doubt, this exists for each of the schemes in the list above, in much the same was as Edge / Norla. If you need help on this feel free to reach out.

We currently represent over 250 individuals in defending s.684 notices. In each instance we have been able to provide detailed evidence supporting the existence of a UK presence, whilst detailing extensive legislative arguments to present a comprehensive response. In many cases this has also seen us lodge legal proceedings via the Judicial Review mechanism to further protect our clients.

If you would like further information on how we can implement this for you or if you just need some initial guidance to help you draft your own response, please do not hesitate to reach out via our website.

It is important that these notices are not ignored. Contractors are in a strong position to respond with your own evidence to protect yourselves. If you ignore these notices, HMRC’s position may be deemed accurate by default leaving you limited options in the future.

We appreciate timing is tight on these notices and at this time of year, it understandably gets put on the back burner. We’re operating an emergency helpline throughout the Christmas period and our team will be on hand to assist to keep you protected and hopefully enjoying your festive break.

Have you received a section 684 notice from HMRC? Contact us today to discuss your options with an advisor. Complete the contact form below or email us at info@wttconsulting.co.uk.

24.04.2024 – Discover our latest s.684 update here.

Article

Article

10th December, 2021 I’m often educated by my law trained business partner as to…

Article

Article

2nd July, 2021 Crypto Tax- What can we learn from the US? Introduction The…

Article

Article

Child Benefit Tax Return Rules Are Changing – What Is the High-Income Child Benefit…

Article

Article

Navigating Dual Tax Residency: UK and International Rules for Cross-Border Employment Living and working…

Article

Article

Navigating IR35 in 2025: What Businesses and Contractors Need to Know The IR35 Off-Payroll…

We’d love to hear from you!

Whether you simply have a quick question, or were seeking a more formal conversation to discuss your tax needs, drop your details here and we will be in touch! Alternatively, you can contact us on +44 (0)20 3468 0000.