Discover… A Day in the Life of a Contractor

From speaking with our clients, we realised that there are a number of questions that are asked regularly, that affect a large proportion, if not all contractors. We have therefore put together a case study, showing the journey of an individual who has left full time employment for a new working life in contracting, and the tax issues that they face.

Meet Gabrielle

Meet Gabrielle

Introducing our case study subject

My name is Gabrielle and I have had a successful twelve-year career working in IT. For the past five years I have been employed by a large film production company based in London. But during the pandemic, I realised (like a lot of people!) that my priorities had changed. I enjoyed more time at home with my two sons and not having to commute to London every day. I therefore decided to take control of my career and become my own boss.

Last year I left my employment and set up my own company, GLU Consulting Ltd, providing specialist IT consultancy services to film production companies.

Join me on my journey as i leave the comforts of PAYE behind for the independence and flexibility of the world of contracting.

About our case study

Switching from PAYE to Contracting

When you decide to leave your full-time job and become a contractor, it can be a daunting transition. Suddenly, you find yourself responsible for paying taxes instead of having it automatically deducted through Pay as You Earn (PAYE), and this is just the start.

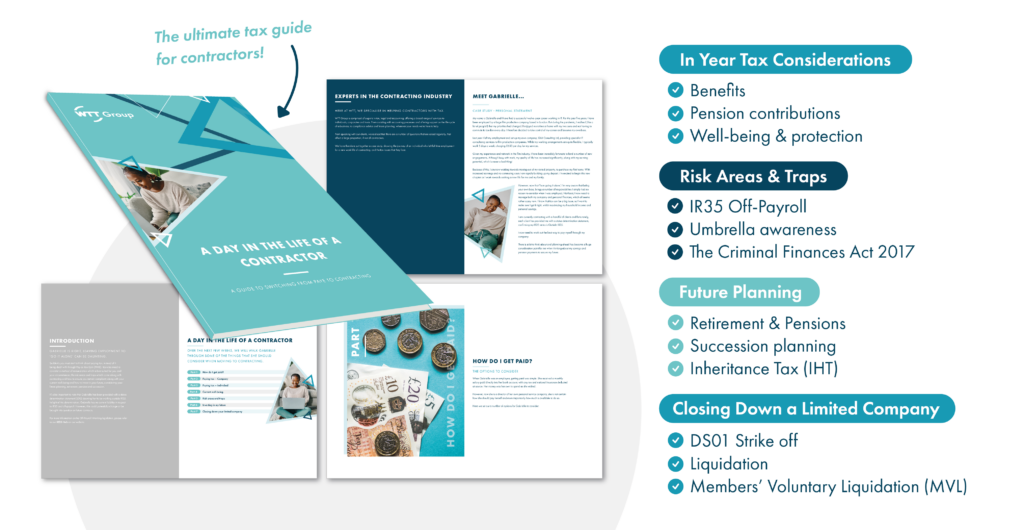

‘A Day In The Life Of A Contractor’ will walk you through the key factors to consider when leaving the security of PAYE behind, including:

- Methods of remuneration

- Personal tax requirements

- Corporation tax requirements

- In year tax considerations

- The risk areas and traps of contracting

- Future planning

- Closing down a limited company

The contractor lifestyle

The contractor lifestyle

Sign up now for exclusive content and advice, following Gabrielle’s steps on switching from PAYE to contracting!

Arrange a callback

We’d love to hear from you!

Whether you simply have a quick question, or were seeking a more formal conversation to discuss your tax needs, drop your details here and we will be in touch! Alternatively, you can contact us on +44 (0)20 3468 0000.